Akaun Terurus (PAMM) — pendapatan tambahan untuk pelabur dan pengurus

Akaun Terurus (PAMM) ialah variasi pengurusan aset apabila seseorang pengurus menggunakan dana berbilang pelabur ke atas sebuah akaun tunggal. Semua keuntungan atau kerugian akan diedarkan di antara peserta mengikut bahagian mereka dalam akaun dan tawaran akaun.

Bagaimana ia berfungsi

- Seseorang pedagang berdaftar sebagai pengurus Akaun Terurus (PAMM) dan membuka satu atau berbilang Akaun Terurus (PAMM).

- Seseorang pelabur berdaftar dengan Kumpulan FIBO dan memilih satu atau berbilang akaun untuk pelabur, dan kemudian memindahkan dana kepada mereka.

- Di akhir setiap tempoh pelaburan, keuntungan atau kerugian yang didaftarkan dalam akaun akan diedarkan di antara pelabur dan pengurus mengikut dana yang mereka laburkan.

Akaun Terurus (PAMM) — pendapatan tambahan untuk pelabur dan pengurus

Akaun Terurus (PAMM) ialah variasi pengurusan aset apabila seseorang pengurus menggunakan dana berbilang pelabur ke atas sebuah akaun tunggal. Semua keuntungan atau kerugian akan diedarkan di antara peserta mengikut bahagian mereka dalam akaun dan tawaran akaun.

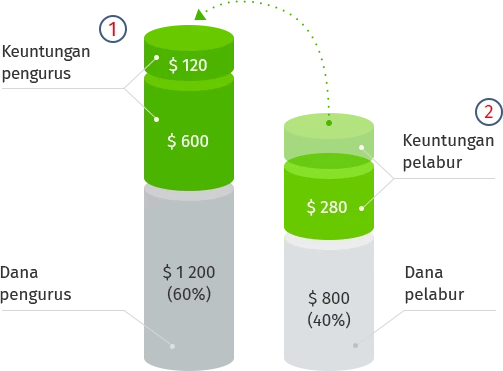

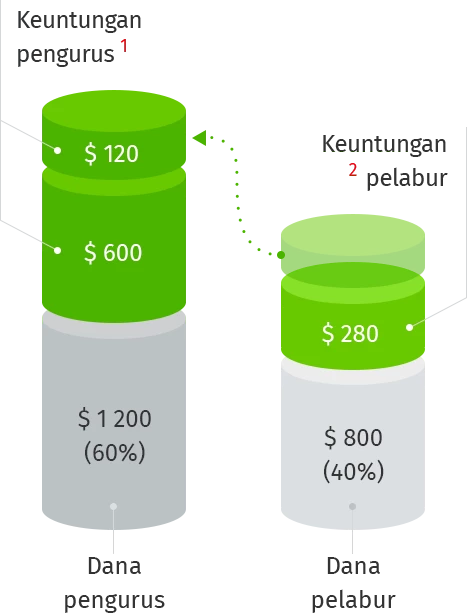

Pengiraan keuntungan

1000 USD

keuntungan umum untuk 1 (satu) tempoh pelaburan

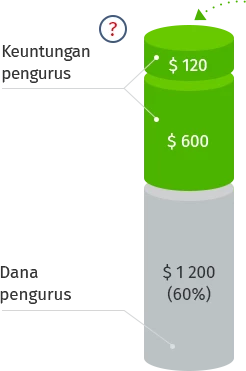

Keuntungan seseorang pengurus akan berjumlah 720 USD.

Daripada itu:

600 USD (60% * 1,000 USD) – keuntungan daripada pelaburan

sendiri

120 USD (30% * 400 USD) – sebahagian daripada keuntungan pelabur

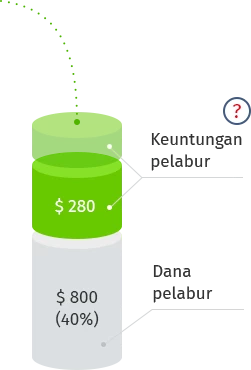

Keuntungan seseorang pelabur

akan berjumlah 280 USD.

Daripada keuntungan pelabur umum (40% daripada 1,000 USD) yuran seseorang pengurus akan dipotong

mengikut syarat tawaran:

400 USD - 30% * 400 USD = 120 USD

2 000 USD

jumlah dana dalam akaun pada permulaan tempoh

- Keuntungan seseorang pengurus akan berjumlah 720 USD.

Daripada itu:

600 USD (60% * 1,000 USD) – keuntungan daripada pelaburan

sendiri

120 USD (30% * 400 USD) – sebahagian daripada keuntungan pelabur - Keuntungan seseorang pelabur

akan berjumlah 280 USD.

Daripada keuntungan pelabur umum (40% daripada 1,000 USD) yuran seseorang pengurus akan dipotong

mengikut syarat tawaran:

400 USD - 30% * 400 USD = 120 USD

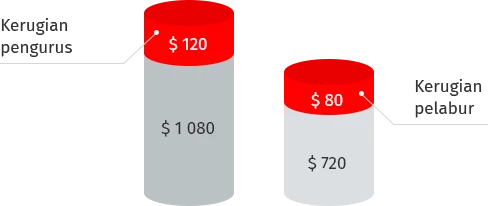

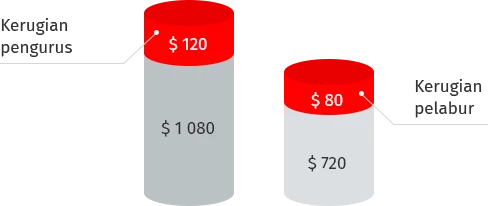

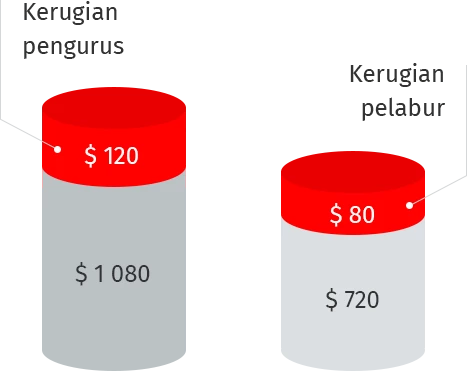

Pengiraan kerugian

Kerugian, sama seperti keuntungan diedarkan mengikut syer pengurus dan pelabur.

Kerugian umum $200

$120 (60% daripada $200) – kerugian pengurus

$80 (40% daripada $200) – kerugian pelabur

200 USD

kerugian umum untuk 1 (satu) tempoh pelaburan

2 000 USD

jumlah dana dalam akaun pada permulaan tempoh

- Keuntungan seseorang pengurus akan berjumlah 720 USD.

Daripada itu:

600 USD (60% * 1,000 USD) – keuntungan daripada pelaburan

sendiri

120 USD (30% * 400 USD) – sebahagian daripada keuntungan pelabur - Keuntungan seseorang pelabur

akan berjumlah 280 USD.

Daripada keuntungan pelabur umum (40% daripada 1,000 USD) yuran seseorang pengurus akan dipotong

mengikut syarat tawaran:

400 USD - 30% * 400 USD = 120 USD

Pada penghujung setiap tempoh pelaburan, seseorang pelabur boleh:

Pilihan 1

Keluarkan semua dana

(pelaburan dan keuntungan))

Pilihan 2

Keluarkan keuntungan sahaja

dan tinggalkan pelaburan permulaan dalam akaun

Pilihan 3

Tinggalkan keuntungan dalam akaun, oleh itu

tingkatkan syer pelabur untuk tempoh pelaburan yang seterusnya

Kelebihan sama

Operasi seimbang (deposit dan pengeluaran), masa pemprosesan pengedaran keuntungan yang betul dan tepat di antara pengurus dan pelabur dipastikan dan dijamin oleh Kumpulan FIBO.

Program "Ejen PAMM" merupakan program perkongsian yang direka untuk menarik pelabur ke PAMM. Pengurus berkongsi ganjaran mereka dengan ejen yang membawa pelabur baru.

- Seorang Pengurus boleh memanfaatkan program ini, kerana amaun dana terurus melebihi keuntungannya.

- Ejen PAMM juga boleh memanfaatkan program ini kerana apabila klien melabur ke Akaun Terurus (PAMM), ejen akan menerima bayaran sehingga dana pelabur berada dalam PAMM.

- Bagi seorang Pelabur, beliau tidak terlibat dalam program ini selagi amaun imbuhan ejen PAMM dinyatakan oleh Tawaran dan dikira sebagai bahagian ganjaran Pengurus.

Amaun ganjaran ejen PAMM ditentukan oleh Tawaran dan dikira sebagai bahagian imbuhan Pengurus.

FAQ

- Bolehkah saya mengubah parameter tawaran bagi akaun Diuruskan (PAMM)?

Tidak, anda tidak boleh mengubah tawaran PAMM. Sebelum menyerahkan permohonan akaun Terurus (PAMM) anda, pastikan anda mengenali peraturan peruntukan perkhidmatan "Akaun diuruskan (PAMM)". Selepas menyerahkan permohonan, pengurus Syarikat akan menghubungi anda untuk menentusahkan parameter tawaran.

- On which accounts is the "Managed account (PAMM)" service available? What is the difference between accounts?

The Managed account (PAMM) service is available in the following account types: MT4 Fixed, MT4 NDD, and MT4 NDD No Commission. Description of their differences can be found in the section "Types of trading accounts". There is also a comparative table of account types.

- Where can I get acquainted with the rules of the "Managed account (PAMM)" service?

The regulations for the service "Managed account (PAMM)" can be found on the Company's website (Home page – “Clients” – “Documents” – subsection “For investors” – “Procedure for provision of the “Managed account (PAMM)” service”).

- Glossary of basic terms and definitions of the Managed Account (PAMM).

Agreement with the Company and has an activated trading or investor account opened in his name.

Managed account (PAMM) — a trading account that allows the Manager to use their own capital and the total capital of Investors for Management in order to make a profit.

Investor account — a non-trading account intended exclusively for withdrawing and depositing funds to a Managed account (PAMM). Each participant has a Managed account (PAMM). One investor account can be used to withdraw and Deposit funds to an unlimited number of managed accounts (PAMM).

Manager — Managed account participant, a Client of the Company who passed the registration procedure as a Manager of a Managed account.

Investor — Managed account participant, a Client of the Company who passed the registration procedure as an Investor of a Managed account.

PAMM-agent — a Client of the Company who passed the registration procedure as a PAMM agent.

Management — the Manager performs speculative trading operations on the world financial markets using the funds of the Managed account (PAMM) in the interests of Investors and for remuneration in the form of a share of the earned profit.

Manager's Offer (Offer) — the specific Manager’s offer for potential Investors to invest in the Manager’s Managed account on specific terms, and for the potential PAMM agents – to attract investments to the Manager’s Managed account for a fee.

Balance transaction — withdrawing or depositing funds to a Managed account.

Managed account balance — sum of the Manager’s Capital, Investors’ Capitals and overall result (profit or loss) of all closed trading positions on a Managed account.

Equity of Managed account — actual total amount of funds of a Managed account, calculated as the amount of Balance and current (floating) profit (or loss) on open trading positions.

Margin — funds reserved as margin collateral for open trading positions.

Free margin — funds not reserved as margin collateral for open trading positions, calculated as the difference between Equity and Margin.

Manager’s Capital – Manager’s own funds deposited to a Managed account.

Manager’s Funds – actual amount of the Manager’s own funds on a Managed account, calculated as the Manager’s share in the amount of the Managed account funds.

Investor’s Capital — Investor’s own funds deposited to a Managed account.

Investor’s Funds — actual amount of the Investor’s own funds on a Managed account, calculated as the Investor’s share in the amount of Funds of a Managed account.

Investment period — a period of time multiple of one week during which the Manager exercises Management of a Managed account and upon the expiration of which settlements and distribution of Profit and Fee between the Manager, Investors and PAMM agents take place.

Manager’s Profit — positive financial result of the Management of the Manager’s Funds.

Investor’s Income — positive financial result of the Management of the Investor’s Capital. It is subject to be distributed between the Manager and Investor upon the expiration of the Investment period.

Investor’s Profit — Investor’s Income minus the Manager’s Fee, minus penalty (if a penalty is prescribed in the Managed account offer).

Manager’s Fee — parameter of the Offer that determines the percentage of the Investor’s Profit to be paid to the Manager.

PAMM Agent’s Fee — parameter of the Offer determining the share of the Manager’s Fee payable to the PAMM agent.

Rating of Managed accounts — list of active Managed accounts on the Company’s site with the option to be rated by the main parameters (currency of account, Manager’s Capital,

total and daily profitability, Offer, etc.).Liquidation of a Managed account — a current Managed account closure procedure initiated by the Manager or the Company.

The Time of the Company (FIBO Time, EET) — the time at which the Company’strading platform and its mobile versions operate. It meets Eastern European Time (EET).

Trading Day — any weekday when the Management of a Managed account is possible. Regarding to a Managed account service, trading days begin and end as follows (EET):

Monday: 00:35 on Monday till 00:35 on Tuesday

Tuesday: 00:35 on Tuesday till 00:35 on Wednesday

Wednesday: 00:35 on Wednesday till 00:35 on Thursday

Thursday: 00:35 on Thursday till 00:35 on Friday

Friday: 00:35 till 23:59:59 on FridayRollover Time — time for statistical data collection, calculations and Balance operations. Corresponds to 00:35 EET of the following days of the week: Tuesday, Wednesday, Thursday, Friday, 05:30 EET Saturday and 23:45 EET Sunday.

- Who trades for me on Managed account? Is it the Company?

It is the manager who operates the Managed account (PAMM). The company registers the results of operation at the end of each investment period and performs funds distribution between investors, manager and PAMM-agents.

- Can you advice me on which Managed account (PAMM) do I invest into?

To choose a Managed account for investment, use the Managed account rating, which can be found on the Company's website "Investors" - "Rating", where all available accounts for investment are presented.

- What is the criterion to sort the Managed accounts (PAMM) in the rating?

By default, the rating of Managed Accounts (PAMM) is formed by the "Account funds" parameter. However, using the settings for sorting, you can make a rating by other parameters: age of the Managed account (PAMM), profitability for different periods, the size of the Manager's Capital, limit the limits of profitability, select the maximum drawdown of PAMM.

- How is the profitability of a Managed Account (PAMM) calculated?

The total profitability (%) shows the total profit or loss of the Managed account on the running total basis from the moment of registration, and is calculated with the formula:

Y=(А1/А * В1/В * … * Z1/Z — 1) * 100%, where:

Y – Total Profitability;

А...А1, B...B1 - Periods between Balance transactions;

А - Initial Balance;

А1 - Equity right before the first following Balance transaction;

B - Equity immediately after the Balance transaction;

B1 — Equity right before the next following Balance transaction;

Z — Equity immediately after the last Balance transaction;

Z1 — Equity at the moment of calculation.

Daily (weekly, monthly) profit shows current profit or loss of the Managed account during particular trading day, current week and month accordingly. Are measured in percentage and calculated by the formula:

Yd (Yw,Ym) = ((Y2 + 1)/(Y1 + 1) - 1) * 100 %, where:

Yd (Yw,Ym) — Daily (weekly, monthly) profit;

Y2 – General Profit at the end of the trading day* (week*,month*) (decimal fraction);

Y1 – General Profit on the beginning of the trading day (week, month) (decimal fraction).

* for current trading day (week, month) - at the moment of calculation.

- Can I talk to the PAMM Manager before I invest in his account?

You may drop a message for the Manager in your Client Area only after you invested in their Managed account (PAMM).

- Does a Manager have access to their investors funds? Can they withdraw an Investor’s funds?

No, no one but Investor can withdraw funds from a Managed account (PAMM).

- Can an Investor see a Manager’s open trades online (live)?

No, this option is not available. However, the Investor has access to information about closed deals and can monitor the dynamics of account funds on the PAMM statistics page.

- How much am I going to profit in a month if I invest $1000?

The profit of a Managed account (PAMM) depends on the activities of its Manager: the correct choice of assets (currency pairs) for investing and managing (trading) them. The results of the work (profit or loss) of the Manager are recorded at the end of each investment period.

- Can I partially withdraw funds from PAMM?

You may withdraw your funds in any volume and with no fee in the end of the Investment period.

- What is the deposit procedure for Managed account (PAMM)?

Managed Accounts (PAMM) deposit is carried out in Client Area, ‘MY PAMM’ section. Money transfer is executed by the Company based on a Client’s request to transfer funds from a trading or invest account.

a) When a Managed Account (PAMM) is credited?

Requests to deposit a Managed Accounts (PAMM) may be submitted any time. Request execution takes place at Rollover time which corresponds to 00:35 EET of the following days of the week: Tuesday, Wednesday, Thursday, Friday, 05:30 EET Saturday and 23:45 EET Sunday.

***When a Managed Accounts (PAMM) is created, the request of a Manager to deposit it is generated and executed automatically upon the Company’s confirmation of the Offer.b) Can I invest in various Managed Accounts (PAMM) at a time?

Yes, the number of Managed accounts (PAMM) selected for investment is not limited.

- I invested (withdrew) my funds in (from) a PAMM, when is my request going to be processed?

All the non-trading (financial) transactions are processed in accordance with ‘Procedure of provision of the ‘Managed account (PAMM)’ service’. Deposits and withdrawals are processed at the upcoming Rollover time which corresponds to 00:35 EET of the following days of the week: Tuesday, Wednesday, Thursday, Friday, 05:30 EET Saturday and 23:45 EET Sunday.

- Can an Investor withdraw their funds from a PAMM any time they like?

Yes, an Investor may withdraw their funds from a Managed Account (PAMM) any time, however in case the withdrawal takes place before the end of the investment period, an Investor may be charged a fee, the amount of which is indicated in the Managed Accounts’s (PAMM) offer. This is introduced to minimize the risks for a Manager in case of unexpected withdrawals that may lead to forced position closure to comply with margin requirements. If a withdrawal (either partial or total) is carried out in the end of the Investment period, funds are withdrawn in full and are not subject to fee.

- Which is more profitable: becoming a Manager or an Investor?

If you are an experienced and successful trader, you may profit more by running your own Managed Accounts (PAMM). Your income is taken both from your own deposit and Manager’s fee.

In case you don’t have enough experience in trading, you may invest into a PAMM. In both cases the profit depends on Manager’s performance. - What is ‘Profit factor’?

Profit-factor is a ratio of the total value of all the completed profitable transactions to the total value of all the completed loss-making transactions for the whole period of existence of the Managed account.

- What is ‘Total net profit’?

Total net profit — is the profit of the Managed account on a running total basis for all the completed transactions for the whole period of existence of the Managed account.

- What is ‘Maximum drawdown’?

Maximum drawdown is a maximum relative decrease of the total profitability comparing with the latest historical maximum value of the total profitability.